Eco-Auto Loan

Buy a Used Electric or Hybrid Car Easily

Enjoy a -40% discount on Eco-Auto Loan! Benefit from special financing conditions when purchasing a used eco-vehicle, or get a preferential Eco-Auto Loan secured by your existing electric or hybrid vehicle.

- Financing up to 100,000

- 4-month grace period

- -40% discounted loan, effective from 29.9%

Loan Up to 100,000

Get approved in just 30 minutes

Special Conditions

-40% discount on the loan interest rate

Effective from 29.9%. Financing designed specifically for electric and hybrid vehicles, with special terms.

4-Month Grace Period

Start repaying the principal from the 5th month.

Caring for the Environment = Personal Comfort

Driving on clean energy means not only saving money but also contributing to a greener future.

The Car Stays in Your Name

To receive the loan, you are not required to transfer vehicle ownership to

anyone else.

Transparency

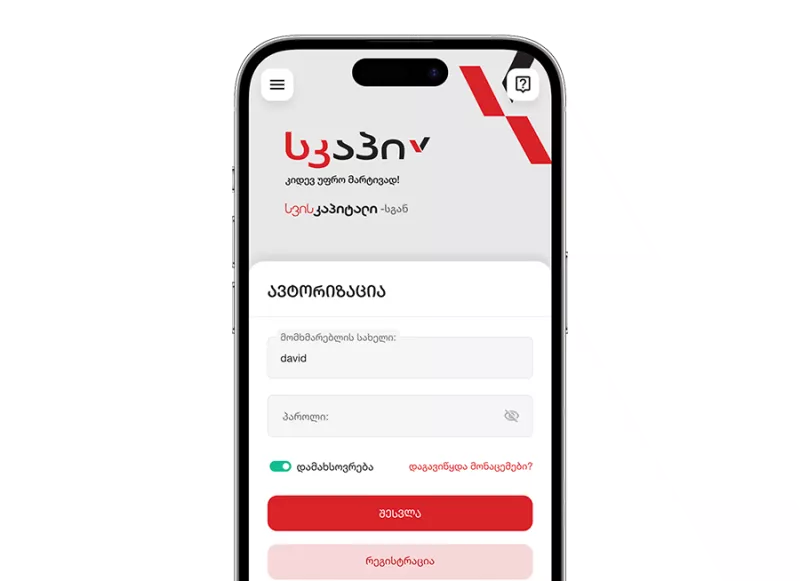

Manage your loan easily through the Scapp mobile app.

Access all your loan information anytime, 24/7, via the client cabinet.

Get Eco Auto Loan Easily

Via the Scapp Mobile App

Receive a loan offer without visiting a branch – simply download the app and apply in seconds.

Via submission

Complete a simple and quick online form.

Visit a Branch

Stop by your nearest Scapp branch to apply in person.

Phone Assistance

Call us at 032 2 300 300 for support.

Important Terms of Eco-Auto Loan

| Type of the Interest Rate | Fixed |

|---|---|

| Annual Interest Rate | From 24.5% |

| Effective Annual Interest Rate | From 29.90% |

| Issuance Commission / Registration Cost | 380 Lari |

| The Full amount and Term of the Credit | 5 000-100 000 Lari, 1-60 Months |

| Early Repayment Commission | 2% - of the repaid amount, if the remaining period is more than 24 months 1% - if 12-24 months remain 0.5% - if 6-12 months remain 0% - if up to 6 months remain |

| Overdue Penalty | 0.27% of the remaining principal for each overdue day. After default begins, total charges (including interest) stop accruing once their total amount reaches 1.5 times the outstanding principal. |

| Note | In case of default, the loan obligation is considered fulfilled only after the realization or appropriation of the collateral securing the loan, in accordance with Georgian law. |