Scapp Continues Expanding Digital Services

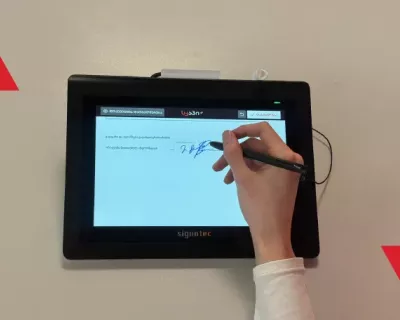

Microfinance organization Scapp has introduced electronic signatures into its service processes.

January 21, 2026

Scapp continues to digitize its services. The mobile application of the microfinance organization - Scapp Mobile, which is a leading digital service channel in the sector, has been enhanced with modern payment methods and new security standards.

What has changed for users?

Previously, borrowers used the app mainly to apply for loans and monitor repayment schedules. Now, users can repay any type of obligation - Auto, Business, Agro, or Gold loans - directly within Scapp. The following options are available:

The full auto loan cycle in one place

This update is especially convenient for Scapp Auto Loan customers, who can now manage every stage - from loan application to repayment - fully remotely, without visiting a branch. Through the Scapp mobile app, users can now:

For additional convenience, the Scapp app also offers biometric authorization via facial recognition (Face ID) and fingerprint authentication, making access even simpler and more secure.

Scapp (formerly “Swiss Capital”) was the first microfinance organization on the market to offer financial services through a mobile application. Today, Scapp Mobile has around 90,000 users. The company continues to develop its mobile app, further simplifying access to financial services for its customers.

To use the new functionality, update the Scapp app, available on both the App Store and Google Play Store.

Learn More

Want to know more?